Personal Loans Los Angeles: Easy Payment Plans You Can Afford

Life in Los Angeles can hit your wallet with surprise expenses. LA residents might need quick cash to fix their car breaking down on the 405 or renovate their Silver Lake home. That’s where personal loans become a lifeline if savings run dry.

Personal loans in Los Angeles, CA, give you flexible funding choices without putting up collateral. You’ll get a fixed amount to borrow and can pay it back through a payment plan that matches your paycheck schedule. On top of that, online lenders make the whole process smooth, from applying to getting your money, often by the next business day. The best LA lenders know you want both good rates and convenience. They’ve built easy-to-use platforms that take the mystery out of borrowing.

Let’s look at how to find affordable personal loans in the City of Angels. We’ll focus on payment plans that fit your budget and lifestyle.

Understanding Personal Loans in Los Angeles

Image Source: CityHealth

Los Angeles offers personal loans in many forms to help people with different financial needs. Borrowers can make better choices by knowing all their available options.

Personal loans in Los Angeles come in two main types: payday loans and installment loans. Payday loans need one big payment by your next payday. Installment loans let you pay back the money over time through multiple scheduled payments.

Each loan type affects your finances differently. Your monthly budget can handle installment loans better because they have steady payments. Payday loans need one big payment that could eat up your next paycheck. Installment loans also give you more money than the smaller payday loans.

Here’s how these loan options compare:

| Feature | Installment Loans | Payday Loans |

|---|---|---|

| Repayment | Multiple payments | Single payment |

| Loan Amount | Generally larger | Typically smaller |

| Term Length | Extended period | Until next payday |

| Payment Schedule | Fixed payments | Lump sum |

Los Angeles lenders look beyond traditional credit scores. They check your bank details, verify your income, and look at your other credit history to see if you qualify.

Installment loans give you more ways to pay. You can make extra payments without fees and pay off your loan early to save on interest. These payments line up with your paycheck schedule to help manage your money better.

Getting a personal loan in Los Angeles is simple. You can get an answer the same day if you apply before 3:30 PM EST. Money usually lands in your account by the next business day. Approved borrowers get a clear schedule showing when each payment is due.

My Funding Choices stands ready to help with your personal loan needs in Los Angeles, CA. They work directly with you – no middlemen means quicker decisions and faster funding.

Getting the right loan works just like finding the right shoes – what works for others might not work for you. Take a good look at your income, monthly bills, and how much you can pay back before you pick a loan.

Key Features of Easy Payment Plans

Personal loans in Los Angeles come with payment plans that put convenience and flexibility first. Borrowers can manage their finances better with these well-laid-out repayment options that won’t strain their budget.

Predictable Payment Structures

These payment plans stand out because you’ll know exactly what to expect. Your payments stay the same throughout the loan term, which makes managing your budget easier. The final payment might be a bit lower, but you’ll always know how much to set aside. The plans line up with when you get paid, so they fit naturally into your financial schedule, unlike traditional loans with strict monthly payments.

Automatic Payment Processing

The lender sets up automatic ACH (Automated Clearing House) withdrawals after loan approval. This system gives you several benefits:

- You won’t need payment reminders

- You’re less likely to miss payments

- Your transactions are more secure

Bank holidays might change withdrawal dates sometimes. You can also use bank cards if ACH isn’t your preferred choice.

Flexibility for Early Completion

The best part is that you can make extra payments whenever you want without penalties. This feature lets you:

- Pay more on scheduled dates

- Finish your loan faster

- Save money on interest charges

Convenient Online Management

Everything happens online from start to finish. Approved borrowers get complete documentation with their approved amount, interest rate, total repayment amount, and payment schedule with specific due dates.

The customer support team helps you with questions about your application status or loan terms. My Funding Choices provides personal loans with flexible payment plans in Los Angeles, CA.

Los Angeles residents looking for personal loans with manageable terms will find these payment plans practical. They combine structure with flexibility to provide financial relief without long-term stress about payments.

How to Apply and Get Approved Online

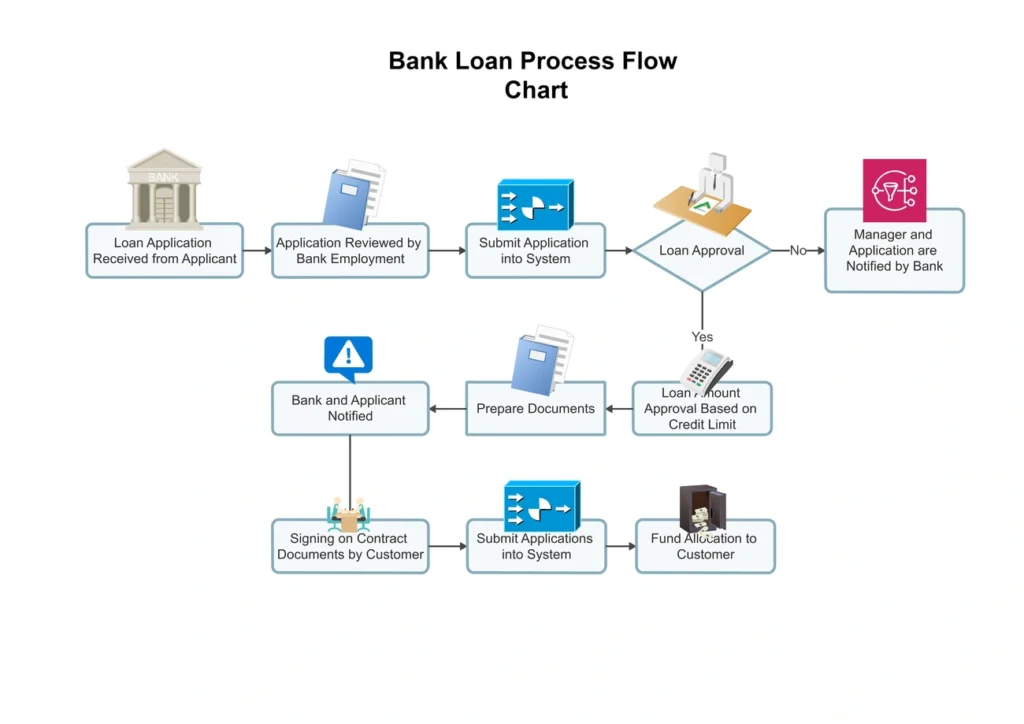

Image Source: Wondershare EdrawMax

Personal loan applications in Los Angeles have become much simpler. The entire process happens online now. You can complete everything from home without visiting any physical locations or making phone calls.

Starting your application is easy. A short online form asks about your personal details, employment, and banking information. Your details go through a specialized scoring system that reviews your eligibility based on alternative data points instead of traditional credit scores. This helps many LA residents who might get turned down by regular banks.

Lenders look beyond FICO scores and check:

- Your banking history shows consistent patterns and good balance maintenance

- Your steady income through pay stubs or regular deposits

- Credit behaviors not reported to major bureaus

The review starts right after you submit your application. You might need to provide extra documents to verify your information. Quick responses help accelerate the process. If you apply before 3:30 PM EST, you could get same-day deposits. Later approvals usually arrive the next business day.

Once approved, you’ll get a detailed loan agreement. This shows your approved amount, interest rate, total repayment, and a complete payment schedule with due dates. Your payment schedule matches when you get paid, since monthly payments aren’t an option right now.

Your lender sets up automatic withdrawals from your checking account through ACH (Automated Clearing House). Despite that, you keep your payment flexibility. You can make extra payments on scheduled dates or pay off your loan early without penalties. This could help you save on interest charges.

Apply with My Funding Choices today for personal loans in Los Angeles, CA. Their direct lending approach cuts out middlemen. This creates a quicker borrowing experience with faster decisions and funding. Customer support is available throughout to answer questions about your application or loan terms.

Conclusion

The right personal loan in Los Angeles ultimately depends on your specific financial needs and situation. This piece examined how these flexible funding solutions operate without requiring collateral. It also got into the main differences between installment loans with multiple scheduled payments and payday loans with single lump-sum repayments.

Reputable lenders’ payment plans make a real difference. Your budget management becomes easier with fixed, predictable payments that line up with your income schedule. Borrowers can save on interest charges and pay off loans earlier since there are no penalties for extra payments.

These loans’ convenience shines through their optimized online application process. Loan applications submitted before 3:30 PM EST usually get same-day processing. The funds typically hit your account by the next business day. This quick response time is a great way to get help during unexpected financial emergencies in Los Angeles.

Note that qualification methods put less emphasis on traditional credit scores. They focus more on banking history, income verification, and alternative credit behaviors. Many Los Angeles residents benefit from this integrated approach, especially those who struggle with conventional financial institutions.

Personal loans in Los Angeles need lenders with clear terms, flexible payments, and a smooth online process. My Funding Choices stands out as a direct lender with quick decisions and no middlemen. Their straightforward personal loans give Los Angeles residents the financial solutions they need with truly affordable payment plans.

FAQs

Q1. What are the key differences between personal loans and payday loans in Los Angeles?

Personal loans typically offer larger amounts with multiple scheduled payments over an extended period, while payday loans provide smaller amounts due in a single payment by your next payday. Personal loans generally have more flexible terms and lower interest rates compared to payday loans.

Q2. How do easy payment plans work for personal loans in Los Angeles?

Easy payment plans feature fixed, predictable payments that align with your income frequency. They often use automatic ACH withdrawals for convenience and allow extra payments without penalties. This structure helps borrowers manage their finances more effectively and potentially pay off loans earlier.

Q3. What factors do lenders consider when approving personal loans in Los Angeles?

Instead of focusing solely on traditional credit scores, many lenders in Los Angeles evaluate banking history, income verification, and alternative credit behaviors. This approach allows for a more comprehensive assessment of a borrower’s financial situation and ability to repay the loan.

Q4. How quickly can I receive funds after applying for a personal loan in Los Angeles?

Applications submitted before 3:30 PM EST often receive same-day processing, with funds typically deposited by the next business day. The entire process, from the funding application, is conducted online for maximum efficiency.

Q5. Are there penalties for paying off a personal loan early in Los Angeles?

Most reputable lenders in Los Angeles do not charge penalties for early loan payoffs. Making additional payments or paying off the loan ahead of schedule is often encouraged, as it can help borrowers save on interest charges and reduce their overall debt more quickly.

Ask ChatGPT

Ask ChatGPT

Ask Perplexity

Ask Perplexity

Ask Claude

Ask Claude

Ask Google AI

Ask Google AI