How to Get a $1500 Personal Loan: Quick Approval Guide (Even With Bad Credit)

A shocking statistic shows that 40% of Americans can’t handle a surprise $400 expense. Life’s financial emergencies don’t wait for the perfect moment, and a quick $1500 personal loan could be exactly what you need.

Unexpected costs hit hard – your car breaks down, medical bills pile up, or your house needs urgent repairs. The good news? Online lenders have made getting a $1500 personal loan substantially easier compared to traditional banks. You might worry about your credit score, but options exist specifically for people asking, “How do I apply for a $1500 personal loan with less-than-perfect credit?”

Direct lenders have evolved their methods. They look beyond just credit scores these days. Your employment status, steady income, and banking habits matter just as much at the time they review your application. This fresh approach has made $1500 personal loans online available to many more borrowers.

This piece covers everything you need to know about securing a $1500 personal loan. You’ll learn about applications, funding times, and ways to pay it back. People who say “I need a 1500 personal loan fast” will find a clear path to getting funds – often as soon as the next business day.

Can You Get a $1500 Personal Loan with Bad Credit?

You might think a $1500 personal loan is out of reach if you have credit problems. Here’s some good news – you can still get a $1500 personal loan even with a poor credit history. Many online lenders now look beyond just your credit score when they review your application.

What lenders look for besides a credit score

Traditional banks focus mainly on credit scores, but alternative lenders take an all-encompassing approach to your $1500 personal loan application. These lenders consider several significant factors:

- Banking information: Your checking account history shows lenders how stable you are financially. They check your banking patterns and how well you maintain your balance.

- Income verification: Regular income shows you can pay back the loan. You’ll need pay stubs, bank statements with regular deposits, or other proof that shows steady income.

- Employment status: A stable job shows you’re financially responsible. Many online lenders care more about this than past credit issues.

Credit history still matters, but these other factors can be just as important or even more so. This broader way of looking at things helps borrowers who might not qualify at traditional banks.

How non-traditional credit checks work

“No traditional credit check” often confuses people. Lenders still check your finances – they just don’t rely only on FICO scores from Experian, Equifax, and TransUnion.

Lenders look at your financial history differently during a non-traditional credit check. They verify everything you submit, but don’t focus on credit scores like banks and credit unions do.

These lenders run their checks and assess risk differently from regular banks. This means people with credit problems might still get the money they need.

The process starts by collecting your basic information. A special scoring system creates your risk profile to determine if you qualify. Everything happens fast, usually within hours.

Why are direct lenders more flexible?

Working with a direct lender for your $1500 personal loan has big advantages over using loan aggregators or brokers. Direct lenders give you a loan without middlemen, which is the quickest way to borrow.

The direct lending process moves faster from beginning to end. They process applications right away. You can get approved in hours instead of waiting for days.

Speed really matters when you need money fast. Most direct lenders handle online applications immediately. If you’re approved before 3:30 PM EST, you could get your money the same day. Later approvals come the next business day.

Everything moves quickly because there’s no middleman slowing things down or adding extra steps. Your application goes straight through their scoring system, which checks everything fast and efficiently. This makes getting a $1500 personal loan easier, even with credit issues.

How to Apply for a $1500 Personal Loan Online

Getting a $1500 personal loan online is quick and simple with modern digital platforms. You can complete everything from home without visiting any office or making long phone calls. Let’s get into what you need and how your application works through the approval system.

Information you need to provide

Your $1500 personal loan application needs several important details:

- Personal details: Full legal name, date of birth, Social Security Number, and contact information, including a valid email address and phone number

- Employment information: Current employer, position, length of employment, and work contact details

- Income verification: Details about your regular income amount and payment frequency

- Banking information: Checking account details where you want the loan deposited, including routing and account numbers

- Identification: Valid government-issued ID information

Most people complete the application form in 5-10 minutes. On top of that, it helps to have recent pay stubs or bank statements showing regular deposits ready, as you might need these during verification.

How the scoring system reviews your data

Your $1500 personal loan application goes through a specialized scoring system that looks beyond traditional credit scores. The system analyzes several alternative data points.

The process starts by checking your banking patterns for consistent income deposits and responsible account management. Your employment stability plays a big role since a steady work history shows you can repay. The system also looks at your income-to-expense ratios to set proper loan amounts.

This different way of evaluation helps people with credit challenges qualify, too. The system creates a full picture instead of just looking at credit scores. My Funding Choices uses this alternative approach, making it a great option for borrowers who want a fair review of their $1500 personal loan application.

What to expect during verification

The evaluation starts right after you submit your application. Here’s what happens during verification:

Automated systems check your submitted information first. You might need to provide extra documents to verify certain details. Quick responses to these requests help speed up the process.

After approval, you’ll get a loan agreement showing:

- Your approved loan amount

- Interest rate and total repayment amount

- Complete payment schedule with specific due dates

Your payment schedule will have equal minimum payments (maybe even a smaller final payment). The system doesn’t accept monthly payments – payments line up with your income frequency instead.

Funds usually hit your account by the next business day if you’re approved before 3:30 PM EST. The lender needs time to check your documents and confirm banking details. The system schedules automatic ACH withdrawals for your payment dates after approval, but you can make extra payments anytime without penalties.

Customer support stays available to answer questions about your application status or loan terms throughout the process. My Funding Choices makes the entire process straightforward and available – even for people with credit challenges. They’re your best bet for a smooth $1500 personal loan application experience.

What to Know About Approval and Funding

The time it takes to get your $1500 personal loan depends on when you submit your application and what verification you need. This guide will help you set realistic expectations and make sure you get your money when you need it.

How fast can you get approved?

Online direct lenders can approve your $1500 personal loan quickly. The whole ordeal takes hours instead of days. Your application goes straight into a specialized scoring system that looks at your information right away.

You’ll likely get your decision the same day because of this quick process. Direct lenders like My Funding Choices make things faster by cutting out middlemen. Your application goes directly through their system with no extra delays.

The verification starts as soon as you submit. Most applicants need to provide:

- Employment and income information

- Banking details

- ID documentation

Quick responses to requests for extra documents will speed up your approval by a lot.

When the money hits your account

Most people see their $1500 personal loan in their account the next business day after approval. The timing matters here. Your money should arrive the next business day if you get approved before 3:30 PM EST.

Lenders need this time to check your documents and confirm your banking information. Everything happens online, so you won’t need to visit any office or make phone calls to get your money.

After approval, you’ll get a loan agreement that shows your amount, interest rate, and payment schedule with due dates. Your payments will line up with how often you get paid, since monthly payments aren’t an option right now.

Same-day vs next-day funding

Here’s what you should know about same-day and next-day funding for your $1500 personal loan:

| Funding Type | Application Timing | When Funds Arrive | Requirements |

| Same-day | Before cutoff (typically 3:30 PM EST) | Sometimes possible same day | Complete application with all verification documents |

| Next-day | After the cutoff or requiring verification | Next business day | Standard for most approved applications |

My Funding Choices offers one of the quickest ways to get your loan. They make quick approval decisions and put money directly in your checking account as soon as they can after verification.

Your verification process determines when you’ll see the money. Some applications need just basic checks and go through faster, while others might need more documents and take a bit longer. In spite of that, most people get their money the next business day after approval.

Bank holidays can affect when you get your money, so plan if you’re applying close to a holiday weekend.

Understanding Your Repayment Terms

Image Source: Integrated Research

Your $1500 personal loan repayment structure should be clear from the start. This helps you plan your finances and avoid any surprises. You’ll get a payment schedule that fits your situation once approved, which makes repayment easy to handle.

How payment schedules are set

The lender creates your payment schedule right after loan approval. You’ll see specific due dates and equal minimum payments listed out. Your last payment might be a bit smaller than the rest. The total amount and length of your loan determine how many payments you’ll make. A $1500 personal loan usually breaks down into several equal payments.

Your payment schedule matches when you get paid instead of following a basic monthly cycle. This means if you get paid every two weeks, your loan payments will follow the same schedule. It’s easier to budget this way since you’ll have money ready when payments are due.

Why are monthly payments not accepted

Online $1500 personal loans work differently from regular bank loans. They don’t usually take monthly payments. This system works better because it matches your actual payday schedule.

This payment setup comes with real benefits. You won’t have to worry about payment dates that don’t match your paychecks. More frequent, smaller payments are easier to handle than big monthly ones. Borrowers can pay off their loans steadily without putting too much strain on their budget.

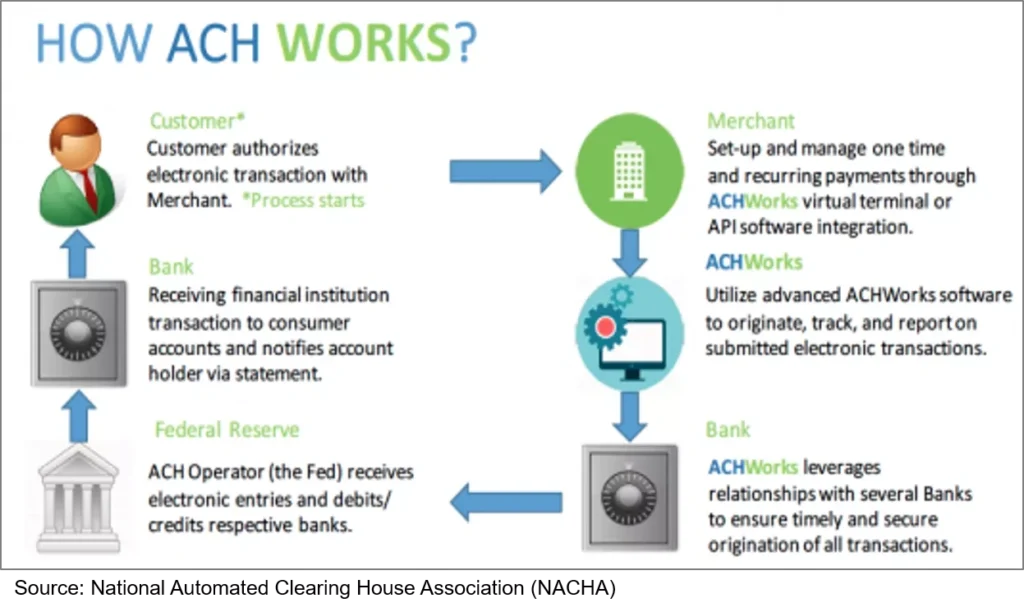

How ACH withdrawals are handled

Most $1500 online personal loans use automatic ACH withdrawals to collect payments. The lender sets up these withdrawals from your checking account after approval. A payment processor handles the transactions on each due date.

ACH payments give you these benefits:

- You don’t need to remember to make payments

- You’re less likely to miss payments

- Your transactions stay secure

Bank holidays might change when your payment goes through if they fall on your due date. The payment usually processes the next business day. Some lenders let you use a bank card if you don’t want ACH payments.

Early payoff options and benefits

Flexible repayment options are a great way to get more from your $1500 personal loan. You can pay more than the minimum whenever you want. This means you can make bigger payments on your scheduled dates to finish your loan faster.

You won’t face any penalties for paying early – that’s better than many traditional loans. Extra payments help you clear your debt sooner and could save you money on interest.

These repayment terms help you manage your $1500 personal loan better. Smart payment planning could save you money in the long run.

Smart Borrowing Tips for Bad Credit Applicants

Smart decisions lead to successful borrowing, especially when you need a $1500 personal loan with credit challenges. These practical strategies help you get the most from your loan and build better financial health.

Apply for only what you need

Your chances of approval increase when you request just the amount you need. A clear purpose and budget show lenders you’re responsible when applying for a $1500 personal loan. Smaller loan amounts with manageable payments boost your approval odds and cost less overall.

Make sure payments fit your budget

Take time to see how payments line up with your paycheck schedule before submitting a $1500 personal loan application. Your payments should fit comfortably within your budget. Most online lenders’ payment schedules match your pay frequency, which makes budgeting easier.

Avoid payday loans if possible

You’ll find better terms with installment loans compared to payday loans. Payday loans need full repayment by your next paycheck, while installment loans let you make multiple scheduled payments. Your finances face less pressure with extended repayment options that give you room to breathe between payments.

Use installment loans to build financial stability

Your financial responsibility shows when you make consistent, on-time payments on your $1500 personal loan. Each timely payment helps improve your financial standing. A predictable payment schedule creates healthy money habits that lead to better financial management skills.

Conclusion

Getting a $1500 personal loan helps cover unexpected expenses, whatever your credit history looks like. Direct lenders have altered the map of borrowing by looking beyond traditional credit scores. They think about your job stability, income proof, and banking patterns to evaluate applications.

You’ll find the online application process quick and convenient. The specialized scoring system evaluates your eligibility right after you submit your information. Approval can come within hours, not days. On top of that, it takes just one business day to see the money in your checking account if you’re approved before the cutoff time.

Your payment schedule will match your income frequency perfectly. This means your loan payments will follow your biweekly paycheck schedule. ACH withdrawals make everything easier, and you’re free to make extra payments without any penalties.

A $1500 personal loan from an alternative lender gives you nowhere near the hassle of payday loans, especially if you have credit issues. Longer repayment periods reduce financial pressure, and regular payments build better money habits. The smartest way to borrow is to take just what you need and make sure payments fit your budget comfortably.

Quick funding, flexible evaluation, and simple repayment options make these loans available to more borrowers. Life’s surprises might catch you off guard, but getting a $1500 personal loan stays simple – just one application away, even with less-than-perfect credit.

Key Takeaways

Getting a $1500 personal loan is achievable even with bad credit, thanks to alternative lenders who evaluate more than just credit scores.

• Bad credit doesn’t disqualify you – Direct lenders consider employment stability, income verification, and banking patterns beyond traditional credit scores

• Apply online for fast approval – Complete applications in 5-10 minutes with approval decisions often within hours, not days

• Expect next-day funding – Funds typically hit your account by the next business day if approved before 3:30 PM EST

• Payments align with your paychecks – Repayment schedules match your income frequency (weekly/biweekly) rather than monthly cycles

• Borrow smart to build stability – Only request what you need, ensure payments fit your budget, and use on-time payments to improve financial health

The streamlined online process eliminates traditional banking hurdles, making emergency funds accessible when you need them most. With automatic ACH withdrawals and no early payoff penalties, these loans offer a practical alternative to payday loans for managing unexpected expenses.

FAQs

Q1. Can I get a $1500 personal loan with bad credit?

Yes, it’s possible to get a $1500 personal loan even with bad credit. Many online lenders now use alternative evaluation methods that consider factors like employment stability, income verification, and banking patterns, rather than relying solely on traditional credit scores.

Q2. How quickly can I receive funds after applying for a $1500 personal loan?

If approved, you can typically receive funds by the next business day. Applications approved before 3:30 PM EST often result in same-day deposits, while later approvals usually arrive the following business day.

Q3. What information do I need to provide when applying for a $1500 personal loan online?

You’ll need to provide personal details, employment information, income verification, banking information, and valid government-issued ID information. The application process usually takes about 5-10 minutes to complete.

Q4. How are repayments structured for a $1500 personal loan?

Repayments are typically structured to align with your income frequency, rather than following a monthly schedule. For example, if you receive biweekly paychecks, your loan payments will likely follow a biweekly schedule as well.

Q5. Are there penalties for early repayment of a $1500 personal loan?

No, there are generally no penalties for early repayment. In fact, you can often make larger payments on scheduled dates to reduce your loan term and potentially save money on interest charges.

Ask ChatGPT

Ask ChatGPT

Ask Perplexity

Ask Perplexity

Ask Claude

Ask Claude

Ask Google AI

Ask Google AI