Same Day Funding Loans Made Easy: Get Cash Within 24 Hours

Nobody can afford to wait days or weeks for traditional loan approval during a financial emergency. Same-day funding loans provide quick access to cash if you need money urgently.

A sudden car breakdown, unexpected medical costs, or home repairs can strain your finances. Same-day funding personal loans offer a faster option than traditional bank loans. The online application process makes everything quick through digital forms and swift approval decisions. These loans are available if you have credit issues or a less-than-perfect credit history. The entire process happens online, so you won’t need to visit any physical locations.

Almost 40% of Americans can’t handle a surprise $400 expense, according to a Federal Reserve survey. This fact shows why quick access to money has become crucial for many families today.

Getting these loans is simple. You fill out a basic form with your personal details, job information, and bank account numbers. Lenders review your eligibility without always checking traditional credit scores. The money goes straight to your bank account within 24 hours after approval.

This piece shows you how same-day funding loans work and who can get them. You’ll also learn smart ways to borrow and repay responsibly.

What Are Same-Day Funding Loans?

Same-day funding loans are short-term financial solutions that give you quick access to funds. You can get your money within 24 hours after approval. These loans help bridge urgent financial gaps without the long waiting times you’d face with regular financing options.

How they differ from traditional loans

Same-day funding loans work differently from regular bank loans. The application process needs minimal paperwork compared to conventional loans. You’ll get an approval decision in minutes or hours instead of waiting for days or weeks.

Traditional banks need extensive credit checks. Same-day funding loans with no credit checks focus on your current income and how you’ll repay. Regular loans often need collateral for bigger amounts. Most online same-day funding loans don’t need security, which means you won’t risk losing your assets.

Types of same-day funding loans available

You can choose from several types of same-day funding loans online:

- Payday loans: Short-term, small-dollar loans due on your next payday

- Installment loans: Bigger loans you repay through multiple scheduled payments

- Personal lines of credit: Flexible borrowing options with revolving credit

- Title loans: Secured loans that use your vehicle title as collateral

Each type meets different needs. Installment options give you easier repayment terms.

Are same-day funding loans legit?

Yes, same-day funding loans are valid financial products from licensed, trusted lenders. You should research providers well before choosing one. Good lenders show all terms, interest rates, and fees upfront.

These loans have higher interest rates than traditional ones, but help people who need money fast. My Funding Choices could be your best option to get same-day funding loans with clear terms and responsible lending practices.

Read all loan terms before you apply. Check the repayment schedules and total borrowing costs to make sure they match your financial situation.

How the Online Application Process Works

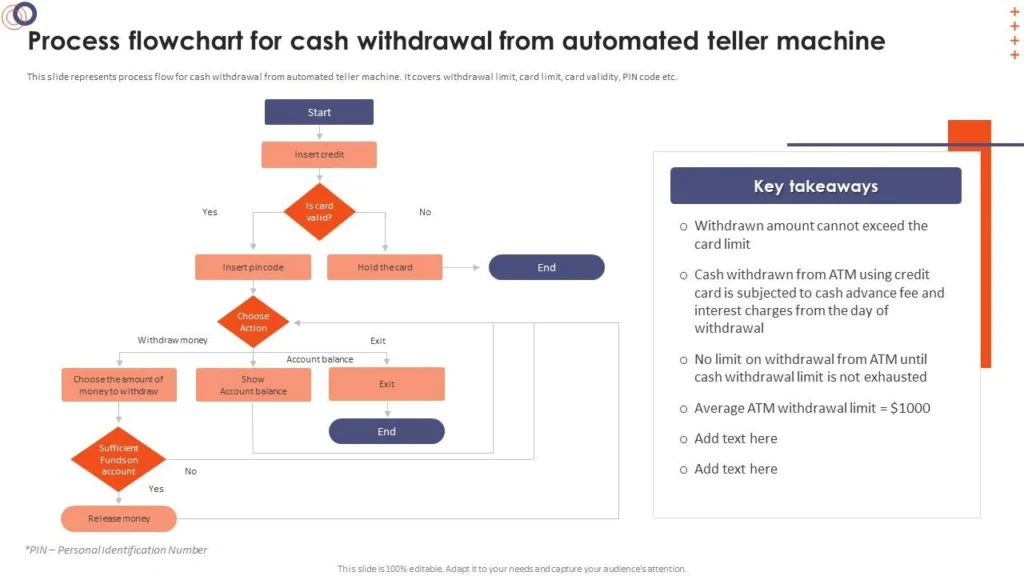

Image Source: SlideTeam

The online application process for same-day funding loans optimizes speed and eliminates paperwork and branch visits. This digital approach puts speed and convenience first without compromising security.

Step 1: Fill out the short online form

You’ll need to complete a simple digital application form. The form asks for:

- Simple personal details (name, address, date of birth)

- Employment information (employer name, income, pay frequency)

- Banking details (account and routing numbers for deposit)

Most people complete the form in just a few minutes. My Funding Choices provides one of the best platforms to get same-day funding loans.

Step 2: Risk scoring and eligibility check

The system analyzes your eligibility as soon as you submit your application. This review looks at:

- Information from your application

- Third-party data sources

- Your current income and banking status

The evaluation process looks beyond traditional credit scores and focuses on your current financial situation and how to repay. This helps people with less-than-perfect credit histories get same-day funding loans.

Step 3: Document verification (if needed)

Some applicants might need to provide extra documents to verify their information. While not always needed, these may include:

- Recent pay stubs

- Bank statements

- Government-issued identification

You can upload these documents through secure online portals that keep the process digital.

Step 4: Approval and same-day deposit

Qualified applicants get their approval notification right away. At this point:

- You’ll see clear loan terms with payment schedules

- All but one of these payments will be equal minimum amounts

- Payments align with your pay schedule

The funds go directly into your bank account within 24 hours once you accept the terms, often the same business day. Automated Clearing House (ACH) transactions handle both the deposit and future repayments on scheduled dates.

Who Can Qualify for Same-Day Loans?

Image Source: Bizway

You need to meet specific criteria to qualify for same-day funding loans. Lenders check these requirements during your application. Knowing what they look for will boost your chances of getting quick financial help.

Minimum requirements to apply

You’ll need these basics to apply for online same-day funding loans:

- Age 18 or older

- Valid government-issued identification

- Regular source of income

- Active checking account

- Valid email address and phone number

Same-day funding loans with bad credit

Bad credit won’t automatically rule you out. Lenders care more about your current income stability and knowing how to repay than just your credit score. People with credit issues often get approved when they meet other criteria.

No credit check options explained

Many lenders now offer same-day funding personal loans using different ways to check eligibility. Yes, it is true – instead of running traditional credit checks, they look at your banking details, verify your income, and review payment history. This way focuses on your current financial health rather than past credit issues.

How employment and bank info affect approval

Your job details show you can repay the loan, and your banking information serves several purposes. It proves who you are and shows financial stability. On top of that, it helps with direct deposits and makes shared repayments possible through ACH transfers. A steady job and a 6-month-old bank account will substantially improve your chances of getting approved for same-day funding loans online.

Tips to Get Approved and Repay Smartly

Your success with same-day funding loans depends on your approach to the application and repayment.

Submit accurate and complete information

The details you provide on your online application form are vital. Your personal, employment, and banking information must be exact. Any mistakes or missing information could delay verification or lead to rejection. Take time to review all entries, especially your income and banking details.

Understand your payment schedule

Read your payment schedule after approval. Your pay frequency determines payment dates, and you’ll make equal minimum payments. The final payment might be lower. Mark these dates on your calendar and make sure you’ll have enough money when payments are due.

How ACH payments work

ACH transactions handle most repayments by automatically taking funds from your bank account on set dates. The system processes payments electronically through a third-party processor. Alternative payment options might be available if you ask.

Paying extra to close the loan early

Same-day funding personal loans let you pay off early without penalties, unlike many traditional loans. You can reduce interest costs and shorten your loan term by paying more than the minimum amount.

Avoiding late fees and penalties

Keep enough money in your account when payments are due to prevent failed ACH withdrawals. Reach out to your lender quickly if you expect payment issues. Many lenders provide options to help with temporary financial challenges.

Conclusion

Same-day funding loans provide quick solutions for financial emergencies. These loans are vital lifelines that give you funds within 24 hours instead of waiting days or weeks like traditional loans. The efficient online application makes these loans available to people who need money fast.

These loans are different from regular options because they look at your current income and how well you can repay, not just your credit history. This helps people with less-than-perfect credit get emergency funds when they need them. The automated ACH repayment system makes it easy to pay back the loan, and you can pay extra or close the loan early without any penalties.

My Funding Choices is your best option to get same-day funding loans quickly. Their clear terms and simple application process help you make smart choices during financial emergencies.

Smart use of same-day funding loans means you should know the terms, have a repayment plan ready, and keep enough money in your account for scheduled payments. While financial emergencies can catch you off guard, being prepared and knowing your quick-funding options helps you stay calm. Getting funds quickly during urgent situations can make all the difference in handling unexpected costs and keeping your finances stable.

Key Takeaways

Same-day funding loans provide crucial emergency financial relief when traditional banking can’t meet urgent timing needs, offering funds within 24 hours through streamlined digital processes.

• Quick access without perfect credit: Same-day loans focus on current income and repayment ability rather than credit scores, making them accessible to borrowers with credit challenges.

• Simple 4-step online process: Complete a short form, undergo risk assessment, verify documents if needed, then receive funds via direct deposit within 24 hours.

• Flexible repayment with early payoff options: ACH automatic payments match your pay schedule, and you can pay extra to close loans early without penalties.

• Key qualification requirements: Must be 18+, have a steady income, an active checking account, and a valid ID – Employment stability and banking history significantly improve approval odds.

• Smart borrowing means accurate applications: Provide complete, precise information and understand your payment schedule to avoid delays, rejections, and late fees.

When financial emergencies strike, these loans bridge the gap between urgent need and traditional loan approval times, but success depends on responsible borrowing and clear repayment planning.

FAQs

Q1. How quickly can I receive funds from a same-day funding loan?

Typically, you can receive funds within 24 hours of approval. The streamlined online application process allows for quick decision-making, and if approved, the money is usually deposited directly into your bank account on the same business day or within one business day.

Q2. Can I qualify for a same-day funding loan with bad credit?

Yes, it’s possible to qualify for a same-day funding loan even with less-than-perfect credit. Many lenders focus more on your current income and ability to repay rather than solely on your credit score. Some even offer no credit check options, evaluating your eligibility based on factors like employment stability and banking information.

Q3. What are the minimum requirements to apply for a same-day funding loan?

Generally, you need to be at least 18 years old, have a valid government-issued ID, a regular source of income, an active checking account, and a valid email address and phone number. Meeting these basic criteria improves your chances of approval.

Q4. How does the repayment process work for same-day funding loans?

Repayments are typically made through Automated Clearing House (ACH) transactions, where funds are automatically withdrawn from your bank account on scheduled dates. The payment schedule usually aligns with your pay frequency, with equal minimum payment amounts except for potentially a lower final payment.

Q5. Are there penalties for paying off a same-day funding loan early?

Unlike many traditional loans, same-day funding loans usually allow early payoff without penalties. In fact, making larger payments than the required minimum can help reduce the overall interest paid and shorten the loan term. It’s a smart strategy if you have the means to pay extra.

Ask ChatGPT

Ask ChatGPT

Ask Perplexity

Ask Perplexity

Ask Claude

Ask Claude

Ask Google AI

Ask Google AI