How to Get a 500 Dollar Loan Today: Fast Approval Guide

A $500 loan can help you stay financially stable when unexpected expenses pop up. Life doesn’t wait for your next paycheck – your car might need repairs, medical bills could pile up, or your home might need urgent fixes.

Money problems can catch anyone off guard. Your appliance might break down, or your pet might need an emergency vet visit. These situations need quick cash right away. Quick $500 loans are a practical solution if you need money fast. Online lenders have optimized their application process. You can get the money the same day or the next business day.

Getting a $500 personal loan is now easier than dealing with traditional banks. You can handle everything from home – apply, get approved, and receive your money. Direct lenders offering instant $500 loans are perfect when you’re short on time.

It’s worth mentioning that you should understand how these loans work before applying. You need to know about the required documents and payment plans. This piece explains everything about getting a $500 loan the same day during financial emergencies.

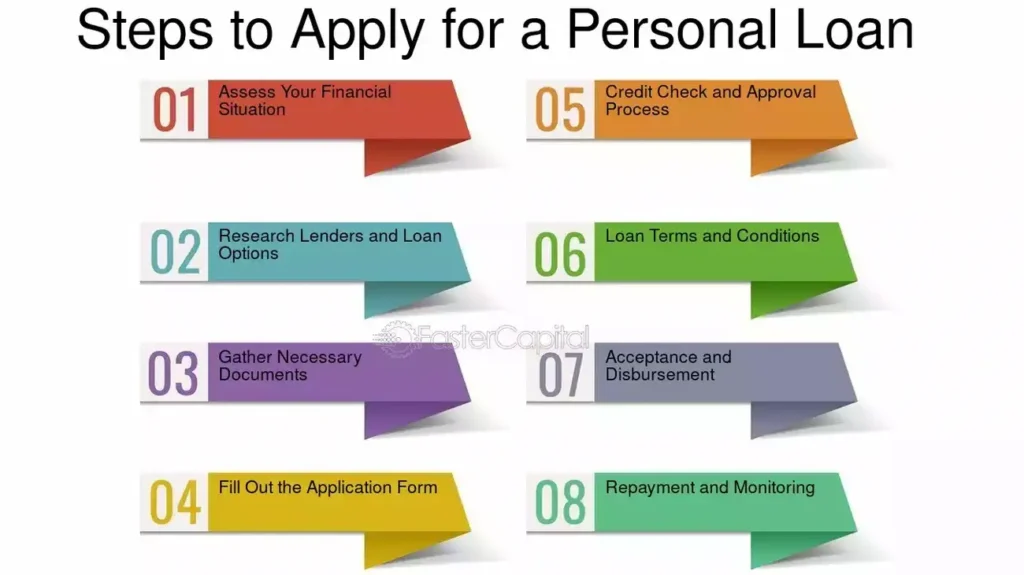

What Is a 500 Dollar Loan and How It Works

Image Source: FasterCapital

A $500 loan is a personal installment loan that lets you pay back the money on a set schedule. These loans come with predictable terms and easy-to-manage payments. They work great when you need to handle surprise expenses or money emergencies.

Fixed payments and structured terms

Personal installment loans work as closed-end credit with clear rules. Once approved, you’ll get a complete payment schedule that shows exactly when payments are due and how much you need to pay. You can plan your finances better because you know what to expect during the loan term.

The $500 loan’s best feature is how payments match your paycheck schedule. Your loan payments will match up if you get paid every two weeks, to name just one example. This setup makes sure you have money ready when payments come due.

Payments happen through ACH withdrawals from your checking account, which makes paying back the loan hassle-free. Your schedule shows equal payment amounts, but the last payment might be a bit lower based on what you still owe.

People who need a quick 500 dollar loan should know they can usually get their money the next day after approval. This works if their application gets processed before 3:30 PM EST on business days.

How is it different from payday or credit card loans

These loans work better than payday loans, which require all their money back by your next payday. A $500 personal loan spreads your payments across several pay periods. This longer timeframe means smaller payments that put less stress on your wallet.

Credit cards have minimum payments that change based on what you owe. But installment loans keep the same payment amount until the end. This makes it easier to budget your money.

There’s another reason these loans stand out – the approval process. Regular lenders mostly look at credit scores. But companies offering 500-dollar loans today look at things differently. They check your current money situation, like your job stability and banking activity, instead of just focusing on your credit history.

Most $500 dollar loans from direct lenders let you pay early without penalties. You can make extra payments on due dates if you have spare money. This might help you finish the loan faster and save on interest.

Steps to Prepare Before Applying

Getting ready the right way boosts your chances of landing a 500 dollar loan fast. Your loan approval becomes easier when you organize your finances and paperwork ahead of time.

Check your current income and expenses

A full picture of your financial situation sets you up for success. Start by making a detailed list of all the money coming in:

- Regular employment earnings

- Government benefits

- Supplemental income streams

- Consistent side earnings

- Additional household income

Your monthly expenses need a review to figure out a realistic loan amount and payment schedule that works. This helps you know exactly what you can afford to pay back based on your budget and when you get paid.

Gather required documents

Lenders need specific paperwork to check your identity and financial stability. Your application moves faster when you have these items ready for a quick $500 dollar loan:

- Government-issued ID (driver’s license)

- Recent pay stubs show steady income

- Active checking account information

- Proof of residence and contact details

- Social security number for verification

Having these documents ready before applying can accelerate your approval for a $500 dollar loan the same day.

Ensure your bank account is active

Your banking history shows how well you handle money. Lenders look at recent bank statements to check:

- Consistent income deposits matching your stated earnings

- Responsible account management patterns

- Regular financial activity

A checking account with steady deposits and smart money management makes your application stronger. Your approved $500 personal loan money goes straight to this account, usually by the next business day if approved before 3:30 PM EST.

Direct lenders look at your current banking habits, job stability, and steady income through different review methods. This integrated approach gives you a chance for approval based on how you manage money now, rather than past credit problems.

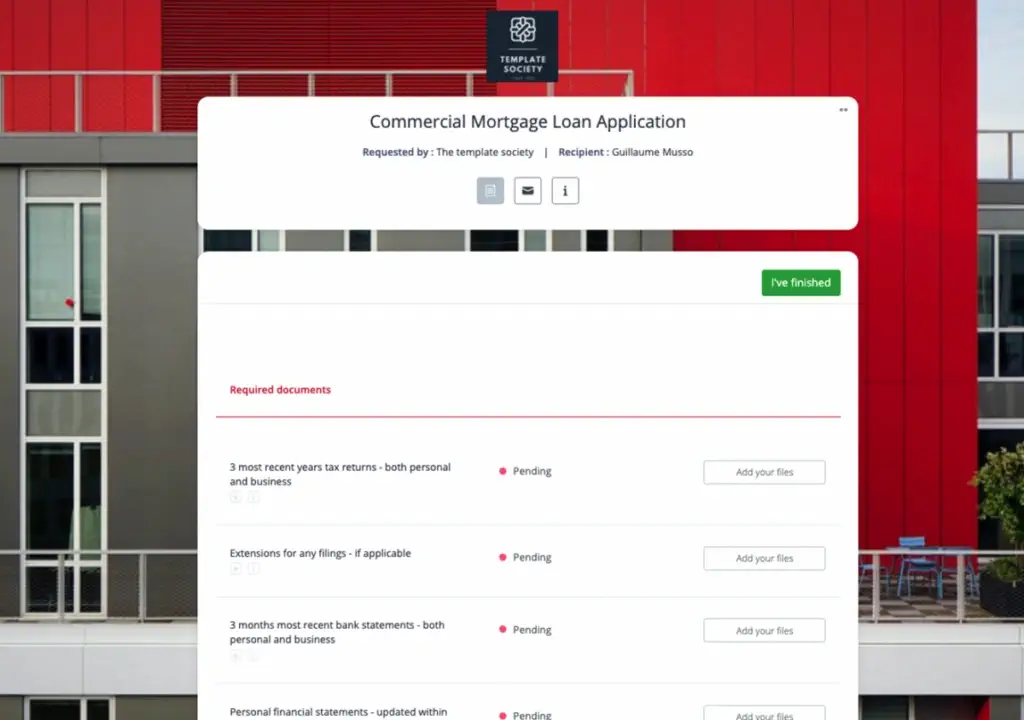

How to Apply for a $500 Loan Online

Image Source: Clustdoc

Getting a $500 dollar loan through digital applications gives borrowers a quick and efficient way to get financial help. You can complete all steps online from your home any time you want, day or night.

Complete the online application form

The process starts with a simple online form. You’ll need to provide:

- Personal details (full name, address, birth date)

- Social security number for identity verification

- Employment information and income sources

- Active checking account details

- Contact information (phone number, email)

The efficient application takes just minutes to complete. You can submit your information whenever it works best for you—even outside regular banking hours. This flexibility works great if you have non-standard work hours or prefer to handle money matters privately at home.

Submit verification documents if requested

Your application might need additional verification. The lender may ask for:

- Recent pay stubs confirming steady income

- Bank statements showing consistent deposits

- Government-issued identification

- Proof of residence

Keep these documents ready to speed up the verification process. Your preparation can substantially affect how quickly you get your $500 dollar loan today. Direct lenders create verification steps that balance responsible lending with quick processing.

Understand how your application is assessed

Direct lenders employ modern assessment methods that go beyond regular credit scores. They look at:

- Current banking activity and account management

- Employment stability and work history

- Income consistency and deposit patterns

- Financial behavior, rather than past credit issues

This approach makes $500 dollar personal loans available to borrowers who might not qualify with traditional banks. Applications submitted before 3:30 PM EST usually get processed faster, which could mean next-business-day funding if approved. The assessment focuses on your current financial situation instead of your old credit history.

What Happens After Approval

Success! Your $500 loan application is approved—what happens next? The post-approval process has several steps from funding to repayment that you should know about.

At the time to expect the funds

Your funds will arrive in your bank account quickly after approval. The money will be deposited into your checking account by the next business day if your $500 loan application gets approved before 3:30 PM EST. This quick funding makes a $500 dollar loan today a real possibility for urgent financial needs.

The process of funding applications optimizes speed. Many borrowers choose this option to handle unexpected expenses. The transfer happens automatically to your checking account that you listed during the application, and you won’t need to do anything else.

How is your payment schedule set

Approved borrowers receive a detailed payment schedule that shows:

- Due dates that are arranged with your pay schedule

- Equal payment amounts (the final payment might be lower)

- Total number of payments based on the loan term

This well-laid-out approach makes your $500 personal loan easy to manage. Your payments match your paydays to create a manageable repayment cycle that works with your financial situation. Your payments are processed through ACH withdrawals directly from your checking account during the loan term. This ensures timely transactions without manual steps.

Options for early repayment without penalties

The most important advantage of a quick 500 dollar loan is the flexibility to repay early. You can make extra payments on regular due dates without extra charges. This option could shorten your loan duration and help save on interest costs.

Your payment structure stays flexible. You can pay more than the minimum whenever your budget allows. You control how quickly you repay your 500 dollar loan from a direct lender. Borrowers often use this option with extra income or bonuses to reduce their debt faster without penalties.

Conclusion

Life’s financial emergencies don’t care about timing. Quick funding options become vital if you need cash fast. This piece explored how 500-dollar loans can help when surprise expenses pop up. These loans give you structured payments that line up with your paycheck. The terms are predictable and easier to manage than payday loans or credit cards.

A full picture of your income and expenses will boost your approval chances. Getting your documents ready will also speed things up. The online application is simple – you can apply from home whenever you want. Your money typically arrives the next business day if you’re approved before the cutoff.

The flexible repayment terms let you pay extra on due dates with no penalties. This could save you money on interest. A 500-dollar loan works well to handle short-term money needs with clear terms. My Funding Choices gives you a reliable way to get your 500-dollar loan quickly with next-day funding.

Smart borrowing matters, whatever lender you pick. Know your terms and make sure the payments fit your budget. A solid plan to pay back the loan will turn these financial tools into helpers rather than hurdles. The right preparation and knowledge can make a 500-dollar loan the perfect bridge during tough financial spots.

FAQs

Q1. How quickly can I receive funds after applying for a $500 loan?

If your application is approved before 3:30 PM EST on a business day, you can typically expect the funds to be deposited into your checking account by the next business day.

Q2. What documents do I need to apply for a $500 loan?

You’ll need to provide a government-issued ID, recent pay stubs, active checking account information, proof of residence, and your social security number for verification.

Q3. Can I repay my $500 loan early without penalties?

Yes, most $500 loans offer penalty-free early repayment options. You can make additional payments on regular due dates without incurring extra charges, potentially reducing your loan duration and saving on interest costs.

Q4. How are $500 loan applications assessed?

Lenders typically evaluate your current financial situation, including employment stability, banking activity, and consistent income, rather than solely focusing on credit history. This approach often makes these loans accessible to a wider range of borrowers.

Q5. How is the repayment schedule for a $500 loan structured?

After approval, you’ll receive a detailed payment schedule with specific due dates aligned with your pay frequency. Payments are usually equal amounts (except possibly the final payment) and are processed through automatic ACH withdrawals from your checking account.

Ask ChatGPT

Ask ChatGPT

Ask Perplexity

Ask Perplexity

Ask Claude

Ask Claude

Ask Google AI

Ask Google AI